A Relief Nonetheless

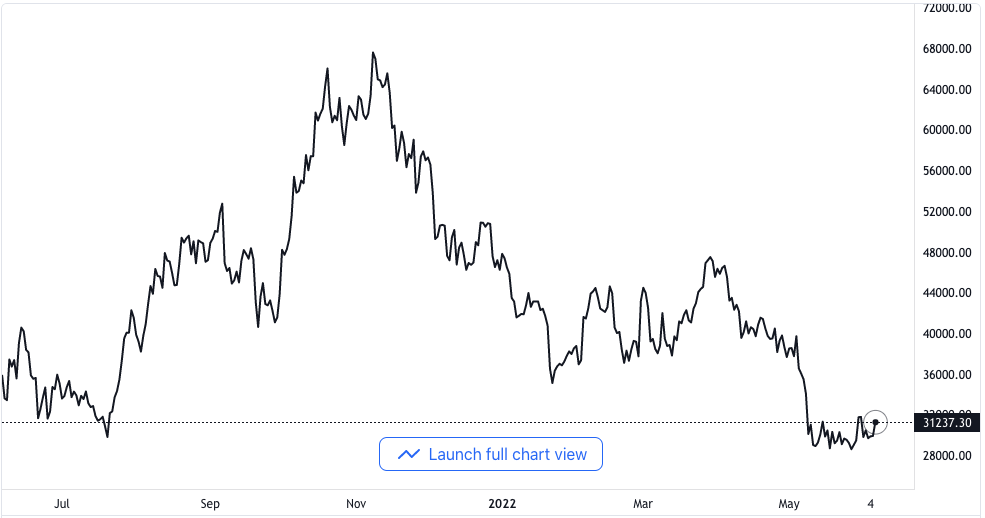

Bitcoin has witnessed a long stretch of volatility for several weeks this year. They seem the most hard-hit by the general downturn in the global crypto crash. However, it recently managed to record a weekly green candle for the first time in several weeks.

While putting this together, the king coin is trading at $30,990, up by 4%. It currently has a market capitalization of $589 billion. In the week, Bitcoin has gained 2.32%.

BTC/USD price chart. Source TradingView

However, this new development could be just a relief for investors only in the short term. There is currently no suggestion that indicates the trend is being reversed. There are speculations that it could be a mere bearish rally.

Analysts have further said that there might be another series of corrections later. Bitcoin still trades well over its 200-period daily moving average.

In times past, Bitcoin had hit the bottom around its 200-period daily moving average. The position is equivalent to being down by 25% from its present position.

According to Rekt Capital, Bitcoin has a tendency to bottom around the 200 weekly moving average. It would take a drop of 25% from the asset’s present position for it to bottom at that level. Rekt Capital is a widely known crypto analytic firm.

Bitcoin Distribution On-chain

According to reports from Glassnode, Bitcoin miners are making huge sales in the course of the market correction. The platform said that the miners have been the net distributors since the sell-off began. Their balance increased of late at a rate of 5,000 to 8,000 Bitcoin per month.

But the miners’ spending has reduced in the past week to 3,300 Bitcoin per month. Quoting CoinMetrics report, Bloomberg revealed that Bitcoin miners have transferred Bitcoin into exchanges. The report puts the figure at close to 200,000 Bitcoin in the month of May.

Some of such miners and sellers involved include top companies like Riot Blockchain. The Director of Content with Mining Marketplace got interviewed by Bloomberg. He said that miners are merely talking about the macro environment. And they think selling Bitcoin at that level is prudent to maintain the safety of operation.

The macroeconomy as a result of several external factors plunged into the crypto ecosystem. The recent collapse of Terra’s blockchain has further worsened the market’s mood as investors are dominantly cautious. Although Terra has launched its second version, the platform is still yet to fully pick up the pace.